Holistic approach to liquid & illiquid asset management

Balancing Liquidity, Diversification, and Long-Term Value Across Every Asset Class.

Every portfolio tells a story. When liquidity, diversification, and long-term purpose move in harmony, wealth becomes more than numbers — it becomes legacy.

Within this holistic view, alternative investments play a vital role. They bring resilience, access to exclusive opportunities, and value creation beyond traditional markets. Since 2012, we have successfully conducted alternative investments worldwide. With a rigorous process, high risk control and constant monitoring, our innovative business model for Alternative investments is one of our great differentials. With a global presence, we have access to the best of breed club deals, managers and business opportunities around the world.

We invest in differentiated products on and offshore through a rigorous governance process.

Close and constant monitoring

Governance

Better return expectations than traditional classes

Case Studies

Real Estate Development

Ultima Capital

- Aug 19

- —

- —

- —

- Dec 23

- Investment Date

- —

- —

- —

- Exit Date

DEAL TERM: 53 months

IRR: 15% p.a. (USD)

MOIC: 1.7x (USD)

The Ultima project involved the sourcing, development, and management of ultra-luxurious accommodations for weekly and mid-length stays. The company owned several properties in ultra-prime locations such as Gstaad, Courchevel, Cannes, Crans-Montana, Corfu, and Geneva.

The investment was made while the company was still private, at a price of CHF 55 per share. The IPO took place shortly thereafter, at CHF 70 per share. In December 2023, Ultima Capital was ultimately sold to a sovereign wealth fund for CHF 107.5 per share.

Real Estate Debt

Fort Collins

- Sep 20

- —

- —

- —

- Dec 22

- Investment Date

- —

- —

- —

- Exit Date

DEAL TERM: 28 months

IRR: 15% p.a. (USD)

MOIC: 1.3x (USD)

The Fort Collins deal consisted of a $9 million mezzanine loan to finance the development of a 197-unit multifamily project in Fort Collins, Colorado, USA. The project represented an attractive opportunity to provide capital to an ongoing development led by a specialized and experienced developer managing over $13 billion in assets.

The loan was granted in September 2020 and was fully repaid ahead of its original 36-month maturity, in December 2022.

Real Estate Debt

Le Montaigne

- Nov 24

- —

- —

- —

- Aug 25

- Investment Date

- —

- —

- —

- Exit Date

DEAL TERM: 9 months

IRR: 15% p.a. (USD)

MOIC: 1.7x (USD)

The Le Montaigne deal consisted of a CHF 18 million bridge loan for the acquisition and refurbishment of a residential penthouse in Monaco. The property, offering 439 m² of living space and outdoor areas with panoramic views over the bay of Monaco, has been fully renovated with a new interior design.

The loan was granted in November 2024 and was fully repaid ahead of its original 12-month maturity, in August 2025.

Real Estate Debt

Raizz II

- May 24

- —

- —

- —

- May 28

- Investment Date

- —

- —

- —

- Exit Date

IRR: ICPA+ 20% p.a.

MOIC: 1.8x

Opportunistic investment for the construction of a logistics warehouse in Itajaí, an extremely buoyant market with high occupancy rates. The warehouse is located near the port of Itajaí, Brazil’s second largest port.

Construction of the warehouse was completed in August, with five lease agreements already signed, totaling 78% of the gross leasable area. The agreements signed have an average value of R$27/m², which is above projections.

Specialty Finance

Asset Leasing Fund

- Sep 21

- —

- —

- —

- Ongoing

- Investment Date

- —

- —

- —

- Exit Date

YIELD: 6% p.a. quarterly (EUR)

TARGET IRR: 8-11% p.a. (EUR)

Investment in a European asset leasing fund focused on mission-critical transportation assets such as medical and safety aviation, railway rolling stock, and specialized maritime equipment. These industries serve essential needs with long-term growth trends, providing the investment with greater resilience across market cycles, as well as low correlation with financial markets.

The deal offers a stable income solution through long-term leasing contracts across a diversified portfolio of more than 200 underlying assets.

Infrastructure

Data Center Platform

- Apr 25

- —

- —

- —

- Ongoing

- Investment Date

- —

- —

- —

- Exit Date

CURRENT IRR: >300% p.a. (EUR)

CURRENT MOIC: >2.0x (EUR)

Direct co-investment in a privately owned data center platform (AiOnX) offering significant value-creation potential driven by the exponential growth of artificial intelligence and the increasing demand for data processing. The platform comprises five development projects located in some of Europe’s most sought-after markets, totaling over 2 gigawatts of power capacity.

The investment was made at a very attractive valuation and is already valued at a >2x MOIC in less than 6 months, with substantial additional value expected to be created through the continued development of the assets and a potential future IPO.

Infrastructure

Via Appia

- Mar 24

- —

- —

- —

- 2028

- Investment Date

- —

- —

- —

- Exit Date

CURRENT IRR: 40% p.a. (USD)

CURRENT MOIC: 3.5x (USD)

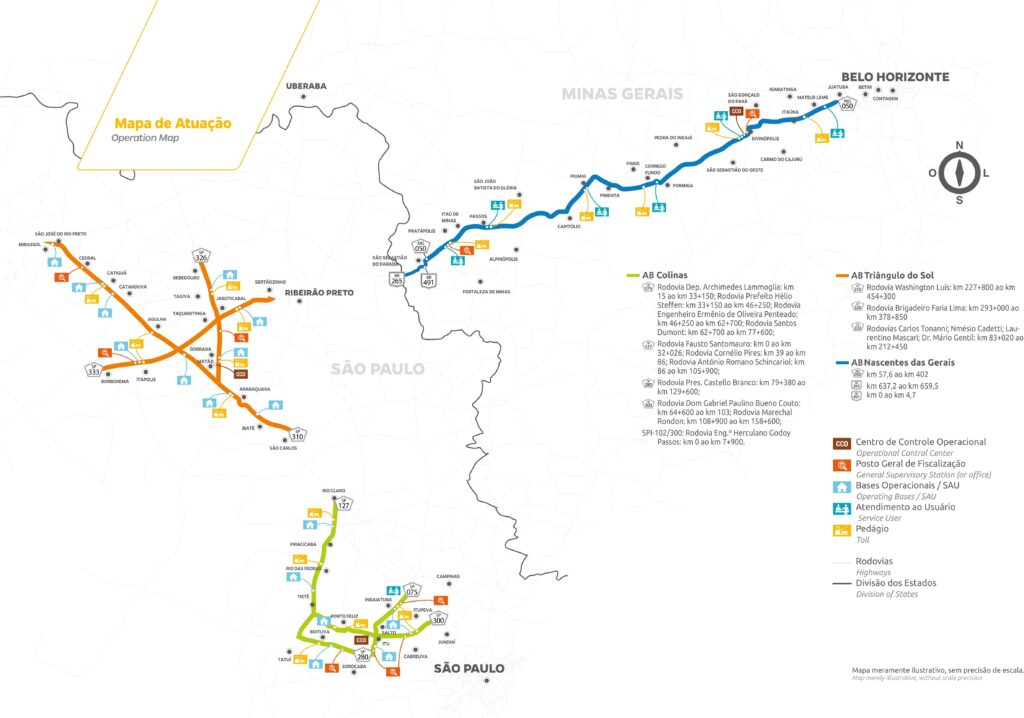

FIP Via Appia began in March 2023 to acquire the holding company AB, owner of the Colinas and Nascente das Gerais concessions. In addition, it won the auction for the northern section of the Rodoanel, which was also incorporated into the structure.

A management turnaround led to the company’s EBITDA growing by 33% in 2024. With robust results, they expect to start paying dividends in December 2025.

Venture Capital

Filevine

- Sep 17

- —

- —

- —

- Oct 25

- Investment Date

- —

- —

- —

- Exit Date

IRR: >60% p.a. (USD)

MOIC: >20x (USD)

ENTRY VALUATION: $21M

Direct investment in Filevine, an American company offering a legal work SaaS integrated suite. The company provides software with a comprehensive suite of tools capable of managing every aspect of a legal case.

The investment in Filevine was initially made during the company’s seed round in September 2017, at an approximate valuation of $21 million. The company completed a new financing round of $400 million in October 2025, and Brainvest exited its direct position at a valuation close to $2.4 billion.

Twistlock

Venture Capital

- May 15

- —

- —

- —

- Jul 19

- Investment Date

- —

- —

- —

- Exit Date

IRR: 97% p.a. (USD)

MOIC: 7.3x (USD)

ENTRY VALUATION: $4.5M

Direct investment in Twistlock, an Israeli cybersecurity company that combines vulnerability management, compliance, and runtime defense for cloud-native applications and workloads.

The investment in Twistlock was made during the company’s seed round in May 2015, at an approximate valuation of $4.5 million. The company was acquired by Palo Alto Networks in July 2019 for a valuation of $436 million.

Private Equity

Salta

- Mar 24

- —

- —

- —

- 2027

- Investment Date

- —

- —

- —

- Exit Date

IRR: 30% p.a.

MOIC: 2.5x

The Salta Group was founded in 2013 from the merger of Pensi and Elite schools, two brands with a solid tradition in Rio de Janeiro. In 2014, the company had 18,000 students and approximately R$140 million in net revenue.

Today, it is the largest basic education group in Brazil, ending 2024 with 130,000 students and net revenue of approximately R$2.3 billion.Thegroup’s differential is quality, with 9 schools among the 100 best in Brazil.

The group has been undergoing rapid expansion, with EBITDA growth of 33% in 2024 and 27% in 1H25, maintaining stable leverage.

Special Situations

V Ports

- Mar 22

- —

- —

- —

- 2027

- Investment Date

- —

- —

- —

- Exit Date

IRR: 45% p.a.

MOIC: 3.0x

Port terminal acquired through a privatization auction of the controlling stake in Docas do Espírito Santos, renamed Vports. The auction took place opportunistically, being the first port privatization in the country, managing to buy the port for only R$ 118.2 million, with a 35-year concession contract. All construction obligations arising from the concession contract were already 100% completed in 2024.

The port has undergone a revaluation that valued it at R$ 1.5 billion (conducted by Ernest Young), as a result of the significant 51% growth in EBITDA and an increase in the port’s infrastructure and operating capacity.